Machine learning (ML) models are popping up everywhere. There is a lot of technical innovation (e.g., deep learning, explainable AI) that has made them more accurate, more broadly applicable, and usable by more people in more business applications. The lists are everywhere: banking, healthcare, tech, all of the above.

However, as with any computer program, models can have errors, or more colloquially, bugs. The process of finding those bugs is quite different from previous technology, and requires a new developer stack. “Soon we won’t program computers, we’ll train them like dogs” (Wired, 2016). “Gradient descent can write code better than you. I’m sorry” (Andrej Karpathy, 2017).

In a deep learning neural network, instead of lines of code written by people, we are looking at possibly millions of weights linked together into an incomprehensible network.

So how do we find bugs in this network? One way is to explain your model predictions. Let’s look at two types of bugs we can find through explanations (data leakage and data bias), illustrated with examples from predicting loan default. Both of these are actually data bugs, but a model summarizes the data, so they show up in the model.

Bug #1: data leakage

Most ML models are supervised. You choose a precise prediction goal (also called the “prediction target”), gather a dataset with features, and label each example with the target. Then you train a model to use the features to predict the target. Surprisingly often there are features in the dataset that relate to the prediction target but are not useful for prediction. For example, they might be added from the future (i.e. long after prediction time), or otherwise unavailable at prediction time.

Here is an example from the Lending Club dataset. We can use this dataset to try modeling predicting loan default with loan_status field as our prediction target. It takes the values “Fully Paid” (okay) or “Charged Off” (bank declared a loss, i.e. the borrower defaulted). In this dataset, there are also fields such as total_pymnt (the payments received) and loan_amnt (amount borrowed). Here are a few example values:

Notice anything? Whenever the loan has defaulted (“Charged Off”), the total payments are less than the loan amount, and delta (=loan_amnt-total_pymnt) is positive. Well, that’s not terribly surprising. Rather, it’s nearly the definition of default: by the end of the loan term, the borrower paid less than what was loaned. Now, delta doesn’t have to be positive for a default: you could default after paying back the entire loan principal amount but not all of the interest. But, in this data, 98% of the time if delta is negative, the loan was fully paid; and 100% of the time delta is positive, the loan was charged off. Including total_pymnt gives us nearly perfect information, but we don’t get total_pymnt until after the entire loan term (3 years)!

Including both loan_amnt and total_pymnt in the data potentially allows nearly perfect prediction, but we won’t really have total_pymnt for the real prediction task. Including them both in the training data is data leakage of the prediction target.

If we make a (cheating) model, it will perform very well. Too well. And, if we run a feature importance algorithm on some predictions (a common form of model explanation), we’ll see these two variables come up as important, and with any luck realize this data leakage.

Below, the Fiddler explanation UI shows “delta” stands out as a huge factor in raising this example prediction because it's data leakage.

There are other, more subtle potential data leakages in this dataset. For example, the grade and sub_grade are assigned by a Lending Club proprietary model, which almost completely determines the interest rate. So, if you want to build your own risk scoring model without Lending Club, then grade, sub_grade, and int_rate are all data leakage. They wouldn’t allow you to perfectly predict default, but presumably they would help, or Lending Club would not use their own model. Moreover, for their model, they include FICO score, yet another proprietary risk score, but one that most financial institutions buy and use. If you don’t want to use FICO score, then that is also data leakage.

Data leakage is any predictive data that you can’t or won’t use for prediction. A model built on data with leakage is buggy.

Bug #2: data bias

Suppose through poor data collection or a bug in preprocessing, our data in biased. More specifically, there is a spurious correlation between a feature and the prediction target. In that case, explaining predictions will show an unexpected feature often being important.

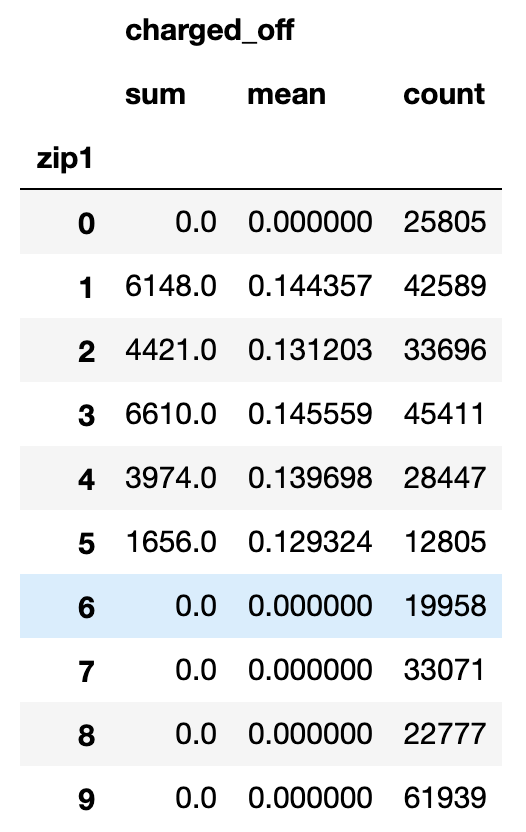

We can simulate a data processing bug in our lending data by dropping all the charged off loans from zip codes starting with 1 through 5. Before this bug, zip code is not very predictive of chargeoff (an AUC of 0.54, only slightly above random). After this bug, any zip code starting with 1 through 5 will never be charged off, and the AUC jumps to 0.78. So, zip code will show up as an important feature in predicting (no) loan default from data examples in those zip codes. In this example, we could investigate by looking at predictions where zip code was important. If we are observant, we might notice the pattern, and realize the bias.

Below is what charge-off rate would look like if summarized by the first digit of zip code. Some zips would have no charge-offs, while the rest had a rate similar to the dataset overall.

In this buggy dataset, there are no charged-off loans with zip codes starting with 6, 7, 8, 9, 0.

Below, the Fiddler explanation UI shows zip code prefix stands out as a huge factor in lowering this example prediction because the model has a bug related to zip code.

A model built from this biased data is not useful for making predictions on (unbiased) data we haven’t seen yet. It is only accurate in the biased data. Thus, a model built on biased data is buggy.

Other model debugging methods

There are many other possibilities for model debugging that don’t involve model explanations. For example:

- Look for overfitting or underfitting. If your model architecture is too simple, it will underfit. If it is too complex, it will overfit.

- Regression tests on a golden set of predictions that you understand. If these fail, you might be able to narrow down which scenarios are broken.

Since explanations aren’t involved with these methods, I won’t say more here.

Summary

If you are not sure your model is using your data appropriately, use explanations of feature importance to examine its behavior. You might see data leakage or data bias. Then, you can fix your data, which is the best way to fix your model.

Fiddler is building an Explainable AI Engine that can help debug models.